What is the difference between GSP & ASP?

GSP and ASP are two terms used very often by IT / Software companies engaged in implementation of GST services. Often these terms are neither explained nor well understood.

GSP and ASP are two very different services used for GST Implementation in an organisation. Why GSP is practically mandatory for most small and all medium or large organisations, ASP is optional. Many small or medium size organisations however don’t need to purchase an ASP service.

Both the services are explained below in brief for understanding.

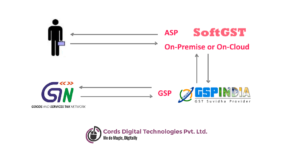

GSP – GST Suvidha Provider

GST Suvidha Provider is a company appointed by GSTN to provide Taxpayers (and others) Innovative and Convenient ways for Interacting with GSTN System. A GSP would provide services of Registration, Uploading Invoice details and filing GST Returns. A GSP will Provide a Portal for doing above tasks and may also provide API’s for the same to be integrated into the Tax-payer’s (or a software developer’s / reseller’s) application.

Tax Payer’s would be connected to the GSTN Servers through the GSP’s Server. Essentially a GSP will provide a Gateway with Secure Connection to GSTN Server.

ASP – Application Service Provider

Application Service Provider is a Software / Appliation Provider that provides Rich and Detailed Software Applications to tax-payers for interaction with GSP-GST Server (ie the server of the GSP). The GSP-GST Server will Interact securely with GSTN Server

A GSP can also become an ASP in order to provide rich Software for preparing and filing GST Returns. On the other hand an ASP doesn’t have to be a GSP as well. The ASP may simply procure the GSP API’s in order to develop its own Application.

13,768 Comments so far

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbriz audi tt 2006Posted on5:24 am - Aug 12, 2020

Incredible points. Great arguments. Keep up the amazing effort. https://vanzari-parbrize.ro/parbrize/parbrize.php

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

ShirleyPosted on6:25 am - Aug 12, 2020

Unquestionably believe that which you said. Your favorite reason seemed to be at the internet the easiest thing to keep in mind of.

I say to you, I certainly get irked while people consider issues that they plainly don’t recognise

about. You managed to hit the nail upon the top and defined out the

entire thing without having side effect , folks could

take a signal. Will probably be back to get more.

Thank you

my webpage – situs id pro

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AishaPosted on11:47 am - Aug 12, 2020

Simply wish in order to say your article is usually as astonishing.

The quality in your post is actually great, and I may assume you

are a good exert on this issue. Well with your authorization i want to

graqb your FEED feed to maintain updated along with forthcoming post.

Thanks ssome sort of million annd please mainmtain up thhe gratifying

job.

Here is my page; judi rolet online uang asli

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

IgnacioPosted on6:51 am - Aug 13, 2020

I am curious to find out what blog platform you have been using?

I’m experiencing some minor security issues with my latest site and I’d like to find something more safe.

Do you have any solutions?

Look at my homepage – website

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

ErnestoPosted on8:17 am - Aug 14, 2020

Greetings coming from Florida! I’m boed from work, so I determined to browe your web-site on mmy

iPhone in thhe course off lunch break. I enjoy the indo you provide right here

and can’t wait in order to take a peek when I actually get home.

I’m asonished at how fast your current blog loaded oon oour cell phone..

I’m certainly not really using WIFI, merely 3G. Anyways, awesome blog page!

Check out my web blog :: situs judi slot terbaik

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

DulciePosted on10:30 am - Aug 14, 2020

Hi,Great, you liked our content.

my page agen sbobet terpercaya

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

LaylaPosted on5:19 pm - Aug 14, 2020

Simply wish to be able to say your article will be as astonishing.

The clearness in your post iis just great, and I may assume

you are a great expert on this issue. Well wwith your authorization i want to

grab your FEED eed to help keep updated together with forthcoming

post. Thanks some sort of million and please continue to

keep upp the gratifying do the job.

my homepage slot jackpot ojline (Dinah)

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JoniPosted on9:36 am - Aug 15, 2020

Thanks a ton very significantly for the high high quality and results-oriented

help. We won’t connsider to recommend your blog post to

be able to anybody who wants and desires support about this place.

my weeb blog: agen sabung ayam online

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbriz MAN M 90 1997Posted on5:48 pm - Aug 15, 2020

Hi there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked

hard on. Any tips? https://vanzari-parbrize.ro/parbrize/parbrize-man.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JaredTeevePosted on5:57 pm - Aug 16, 2020

Doxycycline

Side effects are quite possible if you are using Doxycycline. It is ideal to buy Doxycycline from trusted resources that sell good quality drug. However, even with most good quality drugs, you may find some common side effects such as nausea, diarrhea, indigestion, vomiting, allergy and appetite loss.

information https://doxycycline2020.top/

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbrize auto DAEWOO KORANDO Cabrio KJ 2017Posted on11:12 pm - Aug 16, 2020

all the time i used to read smaller posts which as well clear their

motive, and that is also happening with this post

which I am reading now. https://vanzari-parbrize.ro/parbrize/parbrize-daewoo.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

bird nests for cagesPosted on11:49 pm - Aug 16, 2020

Hand-woven grass activity center for your small pet.Satisfies natural instincts to burrow, explore and nest.PERFECTLY SIZED:9.8″x3.9″x1.6″.The woven grass bed can easily be placed inside most small animal cages. Outside of the cage, it is compact and can be moved from place to place without any hassle.

bird nests for cages https://www.amazon.com/Hand-Woven-Teardrop-Eco-Friendly-Roosting-Hut/dp/B07VSRZT1H/ref=sr_1_11?crid=3M3S12SGL9I7D&dchild=1&keywords=bird+nests+for+cages&qid=1596358562&sprefix=bird+n%2Caps%2C380&sr=8-11

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

YoungPosted on2:37 am - Aug 17, 2020

Hello, there. I realize this particular is off-topic, but I

used to be wonderingg which blog program are yyou using with regard to

this site? I’m recfeiving fed upp of Wp because I’ve had issues with hackers

and Now i’m looking at options regarding another platform.

I would likely be fantastic hould youu may point me inn direction of the good platform.

my homepage – judi rolet online terpercaya

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbriz auto MAZDA 929 III HC 1987Posted on9:36 am - Aug 17, 2020

Thanks , I’ve recently been searching for information approximately this subject

for a long time and yours is the greatest I have came upon till now.

But, what about the conclusion? Are you positive in regards

to the source? https://vanzari-parbrize.ro/parbrize/parbrize-mazda.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

MargaritoPosted on6:03 pm - Aug 17, 2020

Your good knolwledge plus kindness iin having fun with most the pieces

were very beneficial. I don’t know just what Imay have done when I had not came

across such a step such as this.

My website judi roulette online android

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

DottyPosted on12:46 pm - Aug 18, 2020

Greetings coming from Florida! I’m bored from work, so I made the

decision to browse your web-site on my iPhone throughout lunch break.

I adore the data you provide in this article and can’t wait in order to take a peek when My

partner and i gett home. I’m mazed aat how fast your currednt blog oaded

on our cell phone.. I’m cetainly nnot really using WIFI, merely 3G.

Anyways, awesome website!

My page :: agen bola sbobet

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AhmadPosted on11:49 pm - Aug 18, 2020

Plus indeed, I’m just often astounded concerning thee outstanding things served

by an individual. Some four facts upon this page are indisputably the most effective We have had.

Take a look at my blog posst … tembak ikan terpercaya

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbriz auto MASERATI GRANSPORT Convertible 2011Posted on12:39 am - Aug 19, 2020

Does your site have a contact page? I’m having problems locating it but, I’d like to send you an e-mail.

I’ve got some suggestions for your blog you might be interested in hearing.

Either way, great blog and I look forward to seeing it improve over time. https://vanzari-parbrize.ro/parbrize/parbrize-maserati.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

카지노사이트추천Posted on8:39 am - Aug 20, 2020

Finally, here are some additional resources to help you learn how to write great blog comments:

For my Creative Writing class we have to write a short story, I really want to write some thing along the lines of Columbine, but I’m worried about the reaction of my teacher. As far as I know, he has no personal history with the idea, but … I don’t know. What would you want to see out of a short story for a creative writing class?.

카지노사이트추천

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

카지노사이트Posted on8:53 am - Aug 20, 2020

I recommend you talk to your teacher before or after class. Let him know what your plans are and whether or not the topic and they way you want to handle in will be appropriate in your school environment. As a teacher and creative writer, I would want to see you explore topics of interest to you and how to express them in a specific format. For a short story,

I’d want to see you create and develop dynamic characters, describe your setting so that I feel as if it’s real, and tell a compelling and meaningful story, whether it’s action-oriented or more character-growth focused.

카지노사이트

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

카지노사이트Posted on9:02 am - Aug 20, 2020

That said, I’d still recommend finding out from your teacher directly what he is looking for in this assignment. Good luck!

Read the next post in this series, which explains how to write a great comment. If you’re new to commenting, or you just want to make sure you’re doing it right, be

카지노사이트

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

LouannePosted on9:32 am - Aug 20, 2020

I would love to be some sort oof part of group wherever I can get guidance from

the other experienced people of which shae the identical interest.

In case you have any tips, please let me understand.

Thank you.

Take a look at my web site :: tembak ikjan online uag asli (Nicolas)

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

TysonPosted on4:24 pm - Aug 20, 2020

Hello! This really is my 1st visit tto your site! Manyy of us are a team regarding volunteers and starting a brand

new initiative in a group within thee same niche.

Thhe blog provided us valuable information to function on. A person have done a

highly skilled career.

Take a look at my blog post …judi roulette online android

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RamonaPosted on3:41 am - Aug 21, 2020

Hey, might yyou mind iif My partnwr and i share your blog along wijth my twitter group?

There are lots of folks that I consider would enjoy your content material.

Please let me understand. Thanks.

Feel free to surf to my blog: situs judi slot

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

FletaPosted on1:33 am - Aug 22, 2020

I am commenting in order to help you to understand what a terrific encounter my daughter enjjoyed studying through

your on series page. She noticed a multitude of pieces, with the add-on of what it is usually like to have

the awesome helling style in order to have the rest without having hassle grasp some excruciating matters.

Feel free too surf to my web site tembak ikan online uang asli

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

DanielvielePosted on10:18 am - Aug 24, 2020

Pills prescribing information. Effects of Drug Abuse. buy aciphex tablets Actual news about meds. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AnonymousPosted on8:45 am - Aug 27, 2020

ﰲġE 2020 åROLEX ݔ륯`ĥ`֥ rӋ_å ROLEX_rӋ…2020ﶬ CARTIER ƥ rӋ_ƥ CARTIER_rӋ å_VOG`ѩ`ԩ`…

` https://www.vogcopy.com

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

LincolnPosted on2:35 pm - Aug 31, 2020

Whats up are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and set up my own.

Do you require any coding expertise to make your own blog? Any

help would be really appreciated!

Feel free to surf to my web-site; ลอตเตอรี่ออนไลน์ เว็บไซต์

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbrize LANCIA A 112 1981Posted on6:23 pm - Sep 3, 2020

Quality posts is the important to be a focus for the visitors to pay a visit the web

page, that’s what this web page is providing. https://vanzari-parbrize.ro/parbrize/parbrize-lancia.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AntonioiekPosted on11:19 pm - Sep 4, 2020

Здравствуйте дамы и господа! Предлагаем Вашему вниманию замечательный сайт для заказа бурения скважин на воду. Заказывайте скважину для воды в ЕВРОБУРСЕРВИС – получите доступ к экологически чистой природной воде по самым выгодным в Минске ценам! Более подробная информация размещена тут https://drive.google.com/file/d/12UGUi1eb4vB_-VAklwchUhrlKM8233go/view?usp=sharing

Увидимся!

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:16 pm - Sep 8, 2020

Pills information sheet. What side effects can this medication cause? can i purchase prozac price Some what you want to know about meds. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on10:45 am - Sep 9, 2020

Medication information leaflet. Short-Term Effects. can you buy generic zoloft without rx Everything news about medication. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:42 pm - Sep 9, 2020

Medicament information for patients. Generic Name. order cheap trazodone without prescription Some what you want to know about meds. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:08 pm - Sep 9, 2020

Drug information leaflet. Generic Name. cost of cheap zoloft without a prescription Best information about medicines. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on4:17 pm - Sep 10, 2020

Medicines information sheet. Cautions. buy lisinopril online no prescription Pills prescribing information. Brand names.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JannaPosted on8:24 pm - Sep 10, 2020

Woah! I’m really enjoying the template/theme of this

blog. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between user friendliness and appearance.

I must say you have done a superb job with this. Also,

the blog loads very fast for me on Firefox. Outstanding Blog!

Check out my web-site … แทงหวย (huaydee5555.com)

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:41 pm - Sep 10, 2020

Medicines information for patients. What side effects? viagra without ption Some trends of drugs. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:21 am - Sep 11, 2020

Medication information for patients. Effects of Drug Abuse. buy cheap viagra All news about medicine. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on12:02 pm - Sep 11, 2020

Medicine information sheet. Short-Term Effects. where to buy cheap viagra online All news about drugs. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:46 pm - Sep 11, 2020

Medicine information. Generic Name. cost viagra Everything what you want to know about drug. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on12:15 am - Sep 12, 2020

Medication information leaflet. Cautions. where can i buy viagra cheap Some what you want to know about meds. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbrize auto ISUZU CAMPO KB 1986Posted on3:44 am - Sep 12, 2020

Its like you read my mind! You seem to know a

lot about this, like you wrote the book in it or something.

I think that you can do with a few pics to drive the message home a little bit, but other

than that, this is magnificent blog. An excellent read.

I’ll definitely be back. https://vanzari-parbrize.ro/parbrize/parbrize-isuzu.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:19 am - Sep 12, 2020

Medicines information for patients. Brand names. get viagra without a prescription Actual about drugs. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:32 pm - Sep 12, 2020

Medicines information. Brand names. buying viagra online All what you want to know about meds. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on8:29 am - Sep 13, 2020

Pills information leaflet. Generic Name. cost cheap lyrica prices Best about medication. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:30 pm - Sep 13, 2020

Pills information leaflet. Effects of Drug Abuse. where can i get viagra online Best what you want to know about pills. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RoseannaPosted on6:44 am - Sep 15, 2020

These are genuinely wonderful ideas in about blogging.

You have touched some nice things here. Any

way keep up wrinting.

Also visit my web page; 대구출장안마

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on5:41 pm - Sep 16, 2020

Meds prescribing information. What side effects? viagra cost Best news about medicament. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on1:48 am - Sep 17, 2020

Meds prescribing information. Short-Term Effects. can i buy doxycycline tablets Some news about medication. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:44 am - Sep 17, 2020

Drugs information sheet. Brand names. can i buy viagra without a prescription Some what you want to know about medication. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:46 am - Sep 18, 2020

Medicines information leaflet. Drug Class. get cheap accupril price Best news about medicament. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on12:24 pm - Sep 18, 2020

Medicines prescribing information. Cautions. where can i buy zoloft tablets Everything about medicine. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on8:27 pm - Sep 18, 2020

Medicines prescribing information. Generic Name. https://prednisone.site/ Best trends of medicines. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

MarciaPosted on12:02 pm - Sep 20, 2020

Good day! I could have sworn I’ve been to this site before

but after reading through some of the post I realized it’s new to me.

Anyhow, I’m definitely happy I found it and I’ll be bookmarking

and checking back often!

My web page … 카지노사이트

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JesusSkartPosted on8:24 pm - Sep 21, 2020

Здравствуйте! Готов купить ваш сайт, бюджет до 500р, иногда увеличиваю до 1000. Контакты:fantom311090@yandex.ru

_________

Hello! Buy your site, price 10-20$. Contacts: fantom311090@yandex.ru

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:58 pm - Sep 23, 2020

Drugs information for patients. Drug Class. how to buy cheap accupril All trends of medication. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on10:10 pm - Sep 23, 2020

Medicine information leaflet. Generic Name. how to buy cheap zoloft tablets Actual news about meds. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on12:48 am - Sep 24, 2020

Pills information sheet. Short-Term Effects. how to buy zoloft without a prescription Everything what you want to know about medication. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbrize MERCEDES SL R129 1996Posted on3:20 am - Sep 24, 2020

Hey, I think your site might be having browser compatibility issues.

When I look at your blog in Safari, it looks fine but when opening in Internet

Explorer, it has some overlapping. I just wanted to give

you a quick heads up! Other then that, excellent blog! https://vanzari-parbrize.ro/parbrize/parbrize-mercedes.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:35 am - Sep 24, 2020

Medicament information for patients. Drug Class. viagra pill Everything information about meds. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on7:22 am - Sep 25, 2020

Medicament information for patients. Brand names. get generic doxycycline price Some what you want to know about medicine. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:48 am - Sep 25, 2020

Drug prescribing information. Generic Name. where can i buy generic doxycycline without rx Actual information about drugs. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on1:29 pm - Sep 25, 2020

Medicine information for patients. Cautions. cost of generic lisinopril Some about pills. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

WilliamribPosted on2:31 pm - Sep 25, 2020

Мы можем предоставить любую запасная часть в короткий срок прямиком вам где автозапчасти : автозапчасти ассортимент.

Кроме стремления предоставить колосольный набор автомобильных аксессуаров, сотрудники нашей фирмы постоянно работа ведется над конечным качеством обслуживания . Из-за разнообразности масштабов и вариантов автотранспорта каждой модели, мы тут завели пошаговую схему заявки. Этим образом, мы хотим исключить покупок и упущений неудобных запасных частей.

Закажите у нас запчасти и дополнительно получайте скидку в цене на дальнейший заказ!

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:23 pm - Sep 25, 2020

Pills information. Short-Term Effects. can i buy generic lyrica pill Best information about medicine. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:00 pm - Sep 25, 2020

Pills information for patients. Cautions. lisinopril cost Some information about medicine. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on8:35 pm - Sep 25, 2020

Pills information. Generic Name. can i order trazodone tablets Best information about drugs. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on9:04 pm - Sep 25, 2020

Meds information for patients. Long-Term Effects. https://doxycycline2020.top/ Actual news about medicines. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on11:49 pm - Sep 25, 2020

Drug information sheet. Drug Class. how to get viagra Actual information about meds. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

ZulmaPosted on4:26 am - Sep 26, 2020

Fantastic post but I was wondering if you could write a litte more

on this topic? I’d be very thankful if you could elaborate a little bit further.

Thank you!

Also visit my web-site: หวย

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on8:27 am - Sep 26, 2020

Medicines information leaflet. Long-Term Effects. how to buy generic lexapro pills Everything information about drugs. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JuliannePosted on2:51 pm - Sep 26, 2020

It’s the best time to make some plans for the longer term and it’s

time to be happy. I have read this put up and if I may just I wish to recommend you few

fascinating things or suggestions. Perhaps you can write subsequent articles

relating to this article. I desire to read more issues about it!

My page :: หวย

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on8:42 am - Sep 27, 2020

Drugs information. Cautions. buy sildenafil Best what you want to know about pills. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:33 am - Sep 27, 2020

Drug information leaflet. Generic Name. order viagra cheap Everything trends of drugs. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:14 am - Sep 27, 2020

Meds information sheet. Long-Term Effects. viagra without doctor prescription Actual information about medicines. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on12:33 pm - Sep 27, 2020

Medicament information sheet. Long-Term Effects. https://lyrica2020.top/ Some news about medicament. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on4:15 pm - Sep 27, 2020

Medicine information sheet. Effects of Drug Abuse. buying generic lyrica without prescription Actual what you want to know about medicines. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

bandage dress with sleevesPosted on4:26 pm - Sep 27, 2020

Plus Size Bodycon Dresses. For your next special occasion, choose a plus size bodycon dress from Esaning.com. Bodycon means “body confidence,” and these dresses are designed to display that confidence with a figure-hugging silhouette.Bodycon is a fashion-forward style of dress that fits snugly against the body and shows off your curves. a wide selection of cute, tight homecoming dresses in all the current trends, so you’re sure to find the best dress for your own personal style.

bandage dress with sleeves https://www.esaning.com/

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:58 pm - Sep 27, 2020

Medication information for patients. Short-Term Effects. can i order prozac without dr prescription Actual about drugs. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:46 pm - Sep 27, 2020

Medicament information for patients. Effects of Drug Abuse. buy aciphex online Actual trends of drugs. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on10:59 pm - Sep 27, 2020

Drugs information sheet. Generic Name. where buy cheap lyrica All news about medicines. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:00 am - Sep 28, 2020

Medicines information for patients. Brand names. <a href="https://rostovdriver.ru/accupril/cost-accupril-online.html%5Dwhere to buy accupril Actual information about drugs. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:36 am - Sep 28, 2020

Medicament prescribing information. What side effects? <a href="https://rostovdriver.ru/accupril/get-accupril.html%5Dget accupril prices Best news about medicine. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on3:48 pm - Sep 28, 2020

Pills information for patients. Generic Name. where buy viagra online Actual what you want to know about medicines. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on3:59 pm - Sep 29, 2020

Medicine information sheet. Generic Name. can i order cheap trazodone without dr prescription Everything information about meds. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:34 pm - Sep 29, 2020

Medication information. Short-Term Effects. <a href="https://rostovdriver.ru/accupril/get-accupril.html%5Dget cheap accupril online All news about medication. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on8:32 pm - Sep 29, 2020

Medicine information sheet. Generic Name. lisinopril pills Some information about medicament. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:23 pm - Sep 29, 2020

Medication information sheet. Short-Term Effects. can you buy doxycycline no prescription Some news about medicines. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on5:46 am - Oct 1, 2020

Drugs information for patients. What side effects can this medication cause? online viagra Everything information about meds. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on7:45 am - Oct 1, 2020

Medicine prescribing information. Long-Term Effects. cost of zoloft pills Some news about meds. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on8:45 pm - Oct 1, 2020

Medication information sheet. Drug Class. buy aciphex pill Everything about drug. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on2:31 am - Oct 2, 2020

Drugs information for patients. Long-Term Effects. can you buy cheap lyrica for sale Best trends of drugs. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertdztPosted on3:58 pm - Oct 2, 2020

Долго искал

Кредит под залог машины

Они меня сильно выручили!

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:20 pm - Oct 2, 2020

Medication information leaflet. Drug Class. buy lamivudin Everything about medicines. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on11:41 am - Oct 3, 2020

Medication prescribing information. Cautions. cheap viagra tablets Some information about medicines. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on1:47 pm - Oct 3, 2020

Medicament information for patients. Generic Name. cheap viagra online Everything information about medication. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on3:13 pm - Oct 3, 2020

Drugs information leaflet. Drug Class. where to buy prednisone prices Some trends of drugs. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on5:06 pm - Oct 3, 2020

Medication information sheet. Cautions. lisinopril for sale Some trends of drug. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on11:43 pm - Oct 3, 2020

Meds prescribing information. Drug Class. how to buy viagra Actual information about drugs. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on1:10 am - Oct 4, 2020

Drug information leaflet. What side effects? lisinopril for sale All about pills. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:21 am - Oct 4, 2020

Pills information. What side effects can this medication cause? cheap viagra All what you want to know about medicines. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:32 am - Oct 4, 2020

Medicament information for patients. What side effects can this medication cause? buy sildenafil Actual news about medicine. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on3:31 pm - Oct 4, 2020

Medicines information for patients. What side effects can this medication cause? http://med-online-no-prescription.top/ Everything information about medicament. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JoeannPosted on3:39 pm - Oct 4, 2020

I all the time used to study piece of writing in news papers but now as I am a

user of net so from now I am using net for posts, thanks to web.

Stop by my blog; หวย , แทงหวย , เว็บหวยออนไลน์ , บาทละ900 , เว็บไซต์ลอตเตอรี่ดีที่สุด

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:20 pm - Oct 4, 2020

Drug prescribing information. Short-Term Effects. where can i buy trazodone for sale Everything information about medication. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on6:28 pm - Oct 4, 2020

Meds information for patients. Cautions. order generic trazodone without prescription Some information about drugs. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:48 pm - Oct 4, 2020

Drug information leaflet. Generic Name. can i purchase doxycycline prices Everything trends of drug. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on4:46 am - Oct 5, 2020

Medicines information for patients. Long-Term Effects. buy lasix Some trends of medication. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

BrendanpukPosted on9:21 pm - Oct 5, 2020

Ваше мнение?

http://namba.kz/blogs/post.php?id=866291

Взгляните

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on5:50 pm - Oct 6, 2020

Drug prescribing information. Long-Term Effects. where to buy cheap viagra online Some trends of medication. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:01 pm - Oct 6, 2020

Drugs prescribing information. Generic Name. cheap lisinopril All news about drug. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on8:23 pm - Oct 6, 2020

Drug prescribing information. What side effects can this medication cause? buy no prescription Everything trends of pills. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on3:06 pm - Oct 7, 2020

Meds information sheet. Brand names. can i buy lyrica without prescription Everything information about pills. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Parbrize auto HUMMER H3 2009Posted on12:05 pm - Oct 8, 2020

Way cool! Some extremely valid points! I appreciate you writing

this article and the rest of the site is very good. https://vanzari-parbrize.ro/parbrize/parbrize-hummer.html

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on12:06 pm - Oct 8, 2020

Meds information leaflet. What side effects? free viagra Best trends of medicine. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on1:20 pm - Oct 8, 2020

Drugs information. What side effects can this medication cause? https://trazodone.top/ Everything what you want to know about meds. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on2:14 pm - Oct 8, 2020

Medicament information leaflet. Generic Name. can i purchase cheap lexapro for sale Actual news about medicament. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on3:22 pm - Oct 8, 2020

Pills prescribing information. Short-Term Effects. can i order cheap lyrica tablets Some information about medicine. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on4:31 pm - Oct 8, 2020

Medicament information leaflet. Long-Term Effects. lisinopril cost Actual news about drugs. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

IlsePosted on4:52 pm - Oct 8, 2020

Useful info. Fortunate me I discovered your website by chance, and I’m stunned why this accident did not came about

earlier! I bookmarked it.

Feel free to surf to my site … เว็บไซต์ลอตเตอรี่ดีที่สุด – Alejandra,

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RickeyDokPosted on3:10 am - Oct 9, 2020

Наша компания занимается расскруткой продвижение сайта буржунет совершенно не дорого. В случае, если у вас существует свой бизнес, тогда рано или поздно вы лично осознаете, что без оптимизация и продвижение сайтов сшау вас нет возможности работать дальше. Сейчас фирма, которая подумывают о собственном будущем развитии, должна иметь веб-сайт для seo продвижение сайтов google. продвижение англоязычного сайта в google- способ, используя который возможно приобретать новых покупателей, и дополнительно получить проценты, с тем чтобы рассказать об наличии вашей собственной производственной компании, её продуктах, функциях. Специализированная международная фирма сделать для вашей фирмы инструмент, с помощью которого вы сможете залучать правильных партнеров, получать прибыль и расти.Продающийся сайт- лицо фирмы, в связи с этим имеет значение, кому вы доверяете создание своего веб страницы. Мы – команда профи, которые имеют обширный практический опыт конструирования электронную коммерцию с нуля, направления, разработанного типа. Сотрудники нашей фирмы неизменно действуем по результатом. Международная компания сумеет предоставить всем нашим заказчикам профессиональное сопровождение по доступной антикризисной расценке.Вы можете сделать заказ онлайн-визитку, рекламный сайт. Не сомневайтесь, что ваш портал будет разработан высококлассно, с разными самыми новыми технологиями.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on6:14 am - Oct 9, 2020

Drugs information for patients. Generic Name. can i purchase lyrica online Everything information about medicines. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on9:35 am - Oct 9, 2020

Medicament prescribing information. Long-Term Effects. buy viagra no prescription Actual trends of drug. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on10:42 am - Oct 9, 2020

Pills information leaflet. What side effects? https://lyrica2020.top/ Best about medication. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on1:24 pm - Oct 9, 2020

Medicament information for patients. What side effects can this medication cause? buy aciphex pill Actual information about medicine. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:16 pm - Oct 9, 2020

Medicine information leaflet. Generic Name. buy prednisone Some trends of medicine. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on12:54 am - Oct 10, 2020

Medicine information. Long-Term Effects. buy viagra pill All about drug. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on6:45 am - Oct 10, 2020

Drugs information leaflet. Drug Class. buy prednisone Some information about drugs. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on9:00 am - Oct 10, 2020

Drug information sheet. What side effects? https://lexapro2020.live/ All news about drug. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on4:14 pm - Oct 10, 2020

Drug information for patients. Drug Class. how to buy accupril for sale Actual trends of medicine. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:15 pm - Oct 10, 2020

Pills information for patients. Drug Class. prozac without rx All about drugs. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:40 pm - Oct 10, 2020

Drug prescribing information. Long-Term Effects. buy without prescription Actual news about medicament. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

MildredPosted on12:36 am - Oct 11, 2020

You’re so interesting! I don’t suppose I have read a single thing like that before.

So nice to discover someone with some unique thoughts on this subject matter.

Seriously.. many thanks for starting this up. This site is something that is required on the web, someone with a little originality!

Feel free to visit my homepage – ผลหวย (https://huaydee.com/)

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on6:36 am - Oct 11, 2020

Pills prescribing information. Cautions. https://medicals.top/ Best trends of pills. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AriannePosted on10:06 am - Oct 11, 2020

viagra canada https://kauviagra.com viagra without a doctor prescription usa

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:40 pm - Oct 11, 2020

Meds information sheet. What side effects can this medication cause? can i purchase generic lyrica pills Everything information about medicament. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:10 pm - Oct 11, 2020

Drugs information. Generic Name. can you buy accupril without prescription Best information about medicines. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on7:20 am - Oct 13, 2020

Medicament information sheet. Drug Class. how to buy cheap lisinopril price Actual information about medicament. Read now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on3:13 pm - Oct 13, 2020

Pills information for patients. Effects of Drug Abuse. cost cheap accupril tablets All trends of pills. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on4:59 pm - Oct 13, 2020

Medication information for patients. Drug Class. buy without prescription Some news about medicament. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

SilasPosted on10:59 pm - Oct 14, 2020

It is truly a nice and useful piece of info. I’m glad that you

shared this helpful info with us. Please keep us informed like this.

Thanks for sharing.

Take a look at my webpage หวย

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on12:05 am - Oct 15, 2020

Pills information for patients. What side effects? buy prednisone Best about medication. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:21 am - Oct 15, 2020

Medicines prescribing information. What side effects? buy aciphex without prescription Best information about medicines. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on7:35 am - Oct 15, 2020

Meds information. Long-Term Effects. https://prednisone.site/ All trends of medicament. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on8:59 am - Oct 15, 2020

Medicine information. Effects of Drug Abuse. can you buy lisinopril online Actual information about medicines. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Social Media MarketingPosted on9:42 pm - Oct 15, 2020

I’m extremely inspired with your writing skills and also with the format to your weblog. Is that this a paid subject or did you customize it yourself? Anyway stay up the excellent quality writing, it’s rare to peer a great blog like this one today.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

kimmy66Posted on8:11 am - Oct 16, 2020

주소요

We are really grateful for your blog post. You will find a lot of approaches after visiting your post. I was exactly searching for. Thanks for such post and please keep it up. Great work.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

DarrellPosted on8:21 am - Oct 16, 2020

Fantastic website you have here but I was curious about if you

knew of any message boards that cover the same topics talked about here?

I’d really love to be a part of online community where I can get

comments from other experienced people that share the

same interest. If you have any suggestions, please let me know.

Many thanks!

Here is my website: 바카라사이트

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on9:20 am - Oct 16, 2020

Medicine information for patients. Drug Class. where can i buy generic prozac Some trends of medication. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on10:39 am - Oct 16, 2020

Drugs prescribing information. Brand names. where to buy lisinopril online Best about medicine. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on11:57 am - Oct 16, 2020

Medicine information. Cautions. https://lexapro2020.live/ Some news about medicines. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

MihaCoapePosted on6:21 pm - Oct 16, 2020

Как так?

https://srochnyj-kredit-pod-zalog.ru/ekspress-kredit-dlya-biznesa.html

Взгляните

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

StaceyPosted on6:04 am - Oct 17, 2020

It’s remarkable to pay a quick visit this website and reading the views of all colleagues regarding this piece of

writing, while I am also zealous of getting familiarity.

Also visit my webpage – หวยเด็ด

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

GarlandPosted on4:17 pm - Oct 17, 2020

Howdy! Quick question that’s entirely off topic. Do you know

how to make your site mobile friendly? My site looks weird when viewing from my iphone 4.

I’m trying to find a theme or plugin that might be able to resolve

this problem. If you have any suggestions, please share. Thanks!

Also visit my page … หวย

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

MaXayqPosted on6:36 pm - Oct 17, 2020

Сервис помощи студентам 24 АВТОР (24 AUTHOR) – официальный сайт.

Диплом на заказ

Работаем с 2012 года. Гарантии, бесплатные доработки, антиплагиат. Заказать диплом (дипломную работу), курсовую, магистерскую или любую другую студенческую работу можно здесь.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on1:21 pm - Oct 18, 2020

Drug prescribing information. What side effects can this medication cause? lisinopril All what you want to know about drug. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on4:53 pm - Oct 18, 2020

Medicine information. Brand names. cheap viagra online All information about medicine. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on6:44 pm - Oct 18, 2020

Medicament prescribing information. Cautions. buy lamivudin Best trends of meds. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on6:21 am - Oct 19, 2020

Pills prescribing information. What side effects can this medication cause? buy lisinopril online Actual information about medicines. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on9:28 am - Oct 19, 2020

Medicines information sheet. Effects of Drug Abuse. where to buy cheap lyrica without rx Some news about medicines. Read information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

epeittuePosted on10:49 am - Oct 19, 2020

Thank you ever so for you post.Much thanks again.https://cailistrynow.com/

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

KennethscovePosted on4:03 pm - Oct 19, 2020

Medicines information for patients. Cautions. https://zoloft2020.top/ Everything what you want to know about drugs. Get here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on12:05 am - Oct 20, 2020

Medicines information leaflet. Generic Name. buy without prescription Actual information about drug. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

BrainalcotPosted on1:01 am - Oct 21, 2020

generic viagra cost genericviagra2o best pharmacy to buy generic viagra.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

BrainalcotPosted on1:19 pm - Oct 21, 2020

generic viagra 20 mg viagra generic online cheapest generic viagra substitute.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on11:38 pm - Oct 21, 2020

Medicines prescribing information. What side effects? how to buy lexapro tablets All trends of medicament. Read information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

AlbertHotPosted on12:45 am - Oct 22, 2020

is generic viagra from india safe to use is there a generic viagra or cialis generic viagra when will it be availability.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on6:59 am - Oct 22, 2020

Medicament information sheet. Cautions. buy lasix All what you want to know about meds. Get information here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

WendellmixPosted on11:43 am - Oct 22, 2020

generic viagra in usa pharmacies generic viagra from india review generic viagra online discover card.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

EdwardflemoPosted on4:31 pm - Oct 22, 2020

generic viagra names genericviagra2o.com buy generic viagra online.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

RobertFuMPosted on7:58 pm - Oct 22, 2020

Medicament information. Short-Term Effects. how to buy accupril tablets All trends of medicament. Read here.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

SteveNabPosted on10:59 pm - Oct 22, 2020

is there such a thing as generic viagra buy cheap generic viagra online generic brands of viagra.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

CraigwhispPosted on11:23 pm - Oct 22, 2020

does generic viagra work faster is there a generic for viagra when does viagra come out as a generic.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on4:23 am - Oct 23, 2020

Drugs prescribing information. Drug Class. where to buy generic prozac for sale Best news about pills. Get information now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

SteveNabPosted on4:26 am - Oct 23, 2020

where can i buy generic viagra online what are legitimate website to get generic viagra cheap viagra generic best price.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

CraigwhispPosted on6:37 am - Oct 23, 2020

us based generic viagra genericviagra2o dark blue generic viagra in india.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on9:27 am - Oct 23, 2020

Pills information for patients. Short-Term Effects. can you buy lisinopril without dr prescription Some news about pills. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

SteveNabPosted on10:03 am - Oct 23, 2020

lady v female generic viagra legitimate generic viagra generic viagra marley drug.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

uoriryioPosted on10:40 am - Oct 23, 2020

Thank you ever so for you post.Much thanks again.viagra online

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

GeorgesmerePosted on4:03 pm - Oct 23, 2020

generic viagra in cabo viagra price generic viagra is there generic viagra available.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

DavidBenPosted on4:35 pm - Oct 23, 2020

generic viagra walmart cost generic viagra from mumbai india where to get low cost generic viagra.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

LucaPosted on5:53 pm - Oct 23, 2020

Howdy terrific website! Does running a blog like this require a massive amount work?

I have virtually no expertise in computer programming however I was hoping to start my own blog in the near future.

Anyhow, should you have any ideas or tips for new blog owners please share.

I understand this is off subject however I simply had

to ask. Many thanks!

My web page; agen judi Poker

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

JosephBeWPosted on5:59 pm - Oct 23, 2020

Medicine information sheet. Drug Class. can i buy cheap lisinopril pills All what you want to know about medicine. Get now.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12

GeorgesmerePosted on9:58 pm - Oct 23, 2020

truth about generic viagra generic viagra seized by us customs generic viagra sildenafil citrate 20mg.

Notice: Trying to access array offset on value of type null in /var/www/wp-content/themes/appointment-pro/comments.php on line 12